PSA: ING is Exiting PH Retail Banking Soon — Here’s What That Means For Your Accounts

Jul 27, 2022 • Kyzia Maramara

Jul 27, 2022 • Kyzia Maramara

Those tucking away their nest egg with ING Philippines will have to say goodbye to major features in their accounts before 2022 ends. The Dutch multinational bank announced last June 24 that they will be exiting retail banking in the country due to “uncertainties in the global economy.” This means removing a lot of features you’re enjoying now. What should you know?

Mark your calendars. On September 1, ING will halt its products and services as well as decommission the ING mobile banking app.

“It will, however, continue to invest in its Wholesale Banking business and global shared services operations in the Philippines,” said the advisory. This isn’t the first time this happened. Last December 2021, ING also left the retail banking market in France.

Here’s a quick list of ING Philippines banking services that will no longer be available starting September:

For a full list of ING services and their availability after August 31, 2022, check out their website.

If you forgot to transfer out your money or close your ING account, don’t panic. You still have access to it even after September 1, 2022. ING will still let you transfer out your money via the app through InstaPay or PesoNet without any transaction fees. Only the inward transfers will be discontinued.

Still worried? ING is supervised by Bangko Sentral ng Pilipinas (BSP) and is a member of the Philippine Deposit Insurance Corporation (PDIC). Your money is insured by PDIC for up to P500,000 guaranteeing your deposit’s safety.

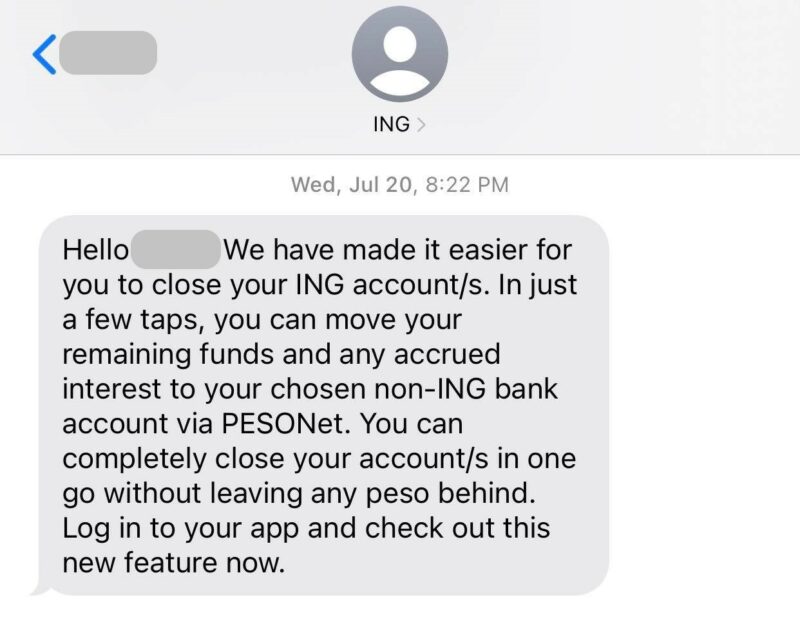

ING has made it easier for you to migrate your deposits out of the app. They have launched a new app feature to make fund transfers seamless. Here’s what it will look like on the app:

ING says the feature “will be available to customers in batches.” Those who have it can go ahead and follow the instructions. Otherwise, you can update your app or wait for the feature to be made available to you.

Looking for a new digital bank to keep your savings? Check out this list of digital banks with high interest rates.

Visit ING’s official website and Facebook page for updates.

What do you think about ING exiting the retail banking market in the Philippines?

Check us out on Facebook, Instagram, Twitter, TikTok, and YouTube, to be the first to know about the latest news and coolest trends!

Kyzia spends most of her time capturing the world around her through photos, paragraphs, and playlists. She is constantly on the hunt for the perfect chocolate chip cookie, and a great paperback thriller to pair with it.

Input your search keywords and press Enter.